On the afternoon of October 21st, U.S. time, Tesla released its Q3 financial report for 2020. and various financial data are surprisingly good. In Tesla’s words, the third quarter of 2020 is a record quarter on many levels.

In terms of market value alone, Tesla has become one of the world’s ten most powerful technology companies. But the outside world defines Tesla, still as a “start-up company.” This also makes us unable to help but produce a curious conjecture: Where is the upper limit of Tesla?

Given that the smart electric vehicles are more imaginative than the smart phone market, is it worth looking forward to whether Tesla surpassed Apple to become the world’s best technology company? At least, Tesla has left unlimited expectations for the outside world after completing the record-breaking third quarter of 2020.

Financial performance: Created the best cash reserve in history

Tesla’s Q3 earnings conference is more like an annual shareholder meeting. If Battery Day were held at this time, Musk would not be too disappointed with media reports. because 2020 Q3 is Tesla’s strongest quarter since it was founded.

From the perspective of financial data.

Tesla’s automotive revenue in this quarter was 7.611 billion US dollars, an increase of 47% from the previous quarter and a year-on-year increase of 42%. Among them, credit supervision was US$397 million, a decrease of 7% from the previous month and a year-on-year increase of 196%.

Tesla’s auto gross profit for the quarter was US$2.105 billion, an increase of 60% from the previous quarter and a year-on-year increase of 72%. The 27.7% auto gross profit margin created the highest value in the past four quarters.

Tesla’s total revenue in the quarter was $8.771 billion, an increase of 45% from the previous quarter and a year-on-year increase of 39%. Among them, the total gross profit was US$2.063 billion, an increase of 3% month-on-month and 73% year-on-year, and the total gross profit margin under the GAAP standard was 23.5%. In addition, Tesla’s operating expenses in the quarter were US$1.254 billion, an increase of 33% from the previous quarter and a year-on-year increase of 35%. Among them, operating profit was US$809 million, an increase of 147% month-on-month and 210% year-on-year, with an operating profit margin of 9.2%.

Adjusted earnings before interest, tax, depreciation and amortization (EBITDA) was US$1.807 billion, an increase of 49% month-on-month and 67% year-on-year. Among them, the adjusted EBITD margin was 20.6%, an increase of 57 basis points (0.57%) from the previous month and a year-on-year increase of 342 basis points. The net profit attributable to ordinary shareholders under the GAAP standard was US$331 million, a month-on-month increase of 218% and a year-on-year increase of 131%.

The diluted earnings per share was US$0.26. The net profit attributable to ordinary shareholders under non-GAAP standards was US$874 million, an increase of 94% from the previous quarter and a year-on-year increase of 156%, and the diluted earnings per share was US$0.76.

Tesla’s third-quarter financial report fully reflects Musk’s ability to spend money and Tesla’s ability to save money. Tesla’s net cash generated from operating activities in the quarter was US$2.4 billion, an increase of 149% from the previous quarter and a year-on-year increase of 217%. Among them, capital expenditure was US$1.005 billion, an increase of 84% month-on-month and an increase of 161% year-on-year. The resulting free cash flow was US$1.395 billion, an increase of 234% month-on-month and an increase of 276% year-on-year. One of the most important financial indicators is that Tesla’s cash and cash equivalents reached a record US$14.531 billion by the end of the quarter, a 69% increase from the previous quarter and a year-on-year increase of 172%.

Overall, Tesla’s main theme in the third quarter is growth. The above financial data replaces the best performance in the past year, and perhaps the best performance in history.

Delivery outlook: 500,000 per year is within reach

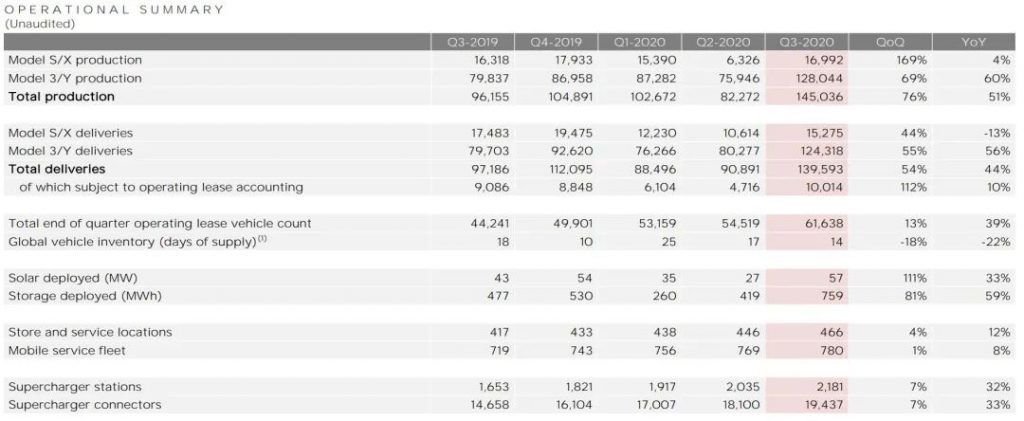

Thanks to the delivery of the Chinese market to record highs, Tesla’s production and delivery capabilities in the third quarter also made history, with its single-season output of 145,036 vehicles, an increase of 76% from the previous quarter and a year-on-year increase of 51%. Among them, Model S/X produced 16,992 vehicles, an increase of 169% month-on-month and 4% year-on-year; Model 3/Y produced 128,044 vehicles, an increase of 69% month-on-month and an increase of 60% year-on-year.

In terms of delivery, Tesla delivered 139,593 vehicles in the third quarter, an increase of 54% from the previous quarter and a year-on-year increase of 44%. Among them, Model S/X delivered 15,275 vehicles, an increase of 44% month-on-month and a year-on-year decrease of 13%; Model 3/Y delivered 124,318 vehicles, a month-on-month increase of 55% and a year-on-year increase of 56%.

As of the end of the third quarter, Tesla’s cumulative delivery volume was 318,980 vehicles, which is 181020 vehicles short of the guidance target of 500,000 vehicles this year. If the target is to be achieved, Tesla’s delivery volume in the fourth quarter needs to increase by 30% from the previous quarter and 61% year-on-year. According to the growth trend in the third quarter, Tesla is close to 500,000 vehicles in the year.

In addition, Tesla’s operating leased vehicles accounted for 10,014 vehicles delivered in the third quarter, an increase of 112% from the previous quarter and a continuous increase of 10%. Finally, at the end of the quarter, operating leased vehicles gradually reached 61,638 units, a 13% increase from the previous quarter and a gradual increase of 39%. Musk once said that Tesla will launch 1 million self-driving taxis in 2020. Now it seems that it is far from the original ambition.

Another very important data indicator in Tesla’s 2020 Q3 financial report is that its global vehicle inventory cycle (number of supply days) has dropped to 14 days, a decrease of 18% from the previous month and 22% from the same period last year. Tesla’s inventory cycle in the first quarter of this year created the worst 25 days in history. In the third quarter, Tesla adjusted this indicator to the second best in history, second only to the 10 days in the fourth quarter of 2019. The sharp decline in the inventory cycle can reduce a huge amount of operating expenses for Tesla. At the same time, this indicator is also an important indicator to test the operating efficiency of automakers.

As of the end of the third quarter, the total number of Tesla’s stores and service outlets was 466, an increase of 4% month-on-month and 12% year-on-year. Tesla, which has created a direct car model, has fewer global stores than a domestic joint venture’s 4S stores. In addition, as of the end of the third quarter, Tesla’s global mobile service fleet size was 780, a month-on-month increase of 1% and a year-on-year increase of 8%.

The popularization of super charging stations in China has made Tesla’s global number of super charging stations increased to 2,181 at the end of the third quarter, an increase of 7% from the previous quarter and a year-on-year increase of 32%. This also allowed the global number of Tesla’s super charging piles to grow to 19,437, an increase of 7% month-on-month and 33% year-on-year. The rapid popularity of super charging stations is also an important driving force to support Tesla’s sales.

Tesla also mentioned in the financial report that the solar energy deployment in the third quarter was 57MW, an increase of 111% month-on-month and 33% year-on-year; the energy deployment in the third quarter was 759MWh, an increase of 81% month-on-year and 51% year-on-year. Tesla, whose mission is to accelerate the world’s transition to sustainable energy, is not just a company that only sells cars.

Production capacity: delivery target of 1 million vehicles next year?

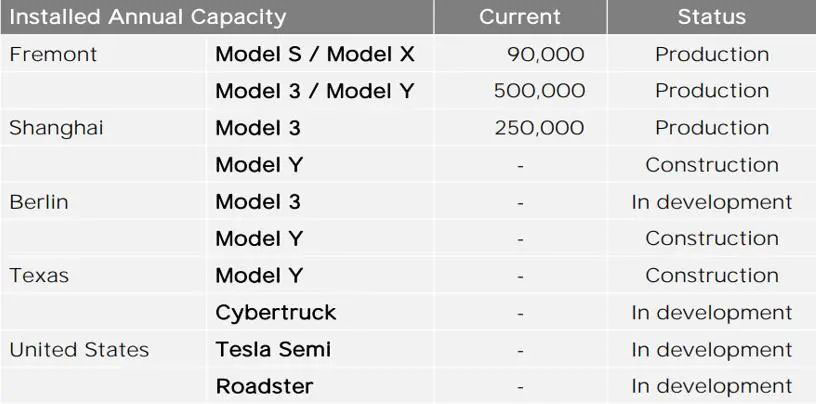

Tesla is currently working towards the goal of 500,000 vehicles a year with full firepower, but Musk has set his sights on next year. As of the end of the third quarter, Tesla has expanded the production capacity of the world’s two existing super factories to 840,000 vehicles, which is close to Musk’s goal of one million vehicles. When a reporter asked on the conference call whether Tesla’s delivery target for next year is 8 to 1 million vehicles, Musk responded: “The target is nearby.”

It can be seen that it is not consumer demand that limits Tesla, but its own production capacity. To this end, Tesla has recently increased the production capacity of the Model 3/Y at the Fremont plant to 500,000 vehicles per year. In order to do this, Tesla restarted the second paint shop, installed the world’s largest die-casting machine, and upgraded the Model Y assembly line. At the end of this year or early next year, production will reach full capacity. Including the Model S/X production line at the Fremont plant, Tesla’s annual production capacity in the United States has reached 590,000 vehicles.

Tesla released a picture of the Model Y painting workshop in the Shanghai Super Factory for the first time in the financial report, which means that the day when the first domestic Model Y goes offline is not far away. Tesla said in the financial report that we are currently building Model Y capacity at the Gigafactory plant in Shanghai, the Gigafactory plant in Berlin and the Gigafactory plant in Texas, and are expected to start delivering from each location in 2021. China is expected to start deliveries at the end of this year or early next year. What is even more amazing is that the production capacity of the domestic Model 3 has increased to 250,000 vehicles per year, and Tesla recently added a third production shift at the Model 3 factory.

Based on the above, Tesla’s current global annual production capacity has reached 840,000 vehicles, and the Model Y production line of the Shanghai plant is about to be completed, and Tesla’s annual production capacity of 1 million vehicles by the end of the year will become a reality.

Tesla also released the Berlin Super Factory and the US TEXAS factory in the financial report. It can be seen that the main construction of the Berlin factory has been roughly completed, and production machines can already be stationed. The TEXAS factory has also completed the foundation construction. At the speed of Tesla’s construction, by the end of 2021, it will achieve the feat of four super factories around the world, and the annual production capacity will exceed 2 million vehicles. At that time, the constraints on Tesla may have shifted from capacity to demand.

The day before the earnings report was released, Tesla stated that it had already rewritten the first FSD (Full Autonomous Driving Capability) software update-urban roads, to a limited number of early experience plan customers. Prior to this, Tesla’s auto-assisted driving team has been focusing on rewriting the infrastructure of neural networks and control algorithms. This rewrite can release the remaining driving functions. In the future, as Tesla continues to collect data, this system will become more powerful.

With its carrot and stick, Tesla may really have a chance to surpass Apple to become the world’s number one technology company. What do you think?

Comments