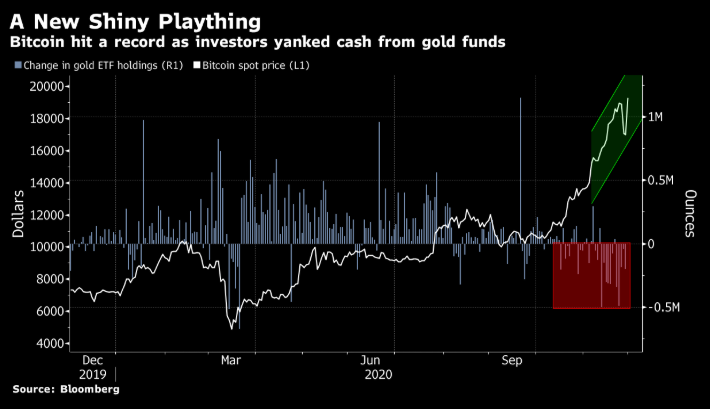

As Bitcoin soars into the sky and set a record, billions of dollars in institutional funds are flowing out of the gold market.

Whether this is purely a coincidence or whether assets have begun to rotate, which will have a profound impact on the cryptocurrency and gold markets, we don’t know yet. However, the topic of whether this world’s largest digital currency will one day compete with gold to hedge inflation and diversify investment portfolios is becoming increasingly popular.

Bitcoin plummeted last week, setting its worst decline since March. Before that, it had risen by 150% during the year. It is this notorious volatility that discouraged mainstream investors.

However, if these investors invest only a small part of their gold holdings in the $350 billion Bitcoin market, perhaps Wall Street’s diversification strategy will be a radical change.

“Gold was indeed a safe asset for the past and baby boomers,Jean-Marc Bonnefous, a former commodity hedge fund manager and now a cryptocurrency investor, said that. Nowadays, gold is being replaced by digital assets such as Bitcoin. ”

Bitcoin trading is dominated by retail players, professional speculators and alternative quantitative funds, while traditional investors have been on the sidelines. But as institutional investors Guggenheim Partners LLC and Paul Tudor Jones and Stan Druckenmiller joined the trend, the wind seems to be changing.

JPMorgan Chase analysts said that funds such as family offices are selling gold exchange-traded fund (ETF) positions and buying bitcoin. Since November 6, gold ETF holdings have fallen by 93 tons, amounting to about US$5 billion. The Grayscale Bitcoin Trust, a Bitcoin investment tool beloved by institutional investors, has doubled its asset size (denominated in US dollars) since the beginning of August.

Comments