[Xinzhiyuan Guide] Recently, the analysis report of BCG Analysis shows that by 2030, China will become the world’s largest chip producer. It also pointed out that Samsung and TSMC have surpassed Intel in semiconductor manufacturing, and Southeast Asia is replacing the United States as the “world chip factory.” In response to this trend, the United States has begun to “intensely” promote the relocation of high-end manufacturing.

Can China’s chip manufacturing industry still survive with the bursting of one core-building bubble after another ?

BCG Analysis is very confident in its analysis.

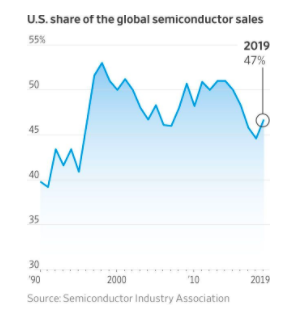

The US and Europe produced more than three-quarters of the world’s semiconductors in 1990.

But now, Europe and the United States account for less than a quarter of the output, and the output of Japan, South Korea, China and Taiwan has exceeded that of the United States and Europe.

According to survey data from BCG Analysis, China will develop into the world’s largest chip producer by 2030.

Chip manufacturing “hinterland” migrates to Southeast Asia, but the US still accounts for half of the world’s total sales

The hinterland of chip manufacturing is migrating to Southeast Asia.

In addition to chip manufacturing, the supplier network of chip companies and experienced semiconductor professional engineers are also attracted by Southeast Asia.

Although manufacturing has been out of the United States for a long time, many of the world’s largest chip companies are still headquartered in the United States.

Intel is still the chip company with the highest sales in the United States. Although it has opened factories in Ireland, Israel and China, most of its production is still in the United States.

In the past, American chip companies thought that they controlled the chip design and could move manufacturing to lower-cost regions, so they outsourced all manufacturing operations to Southeast Asian manufacturers.

For example, most of Nvidia’s chips are produced at TSMC. Nvidia is headquartered in Santa Clara, California, and is the most valuable semiconductor company in the United States. As of 2019, US companies accounted for approximately 47% of total global semiconductor sales.

TSMC’s Samsung process surpasses Intel, and the design software has not yet got rid of the “beautiful font”

TikTok and Huawei have been hit hard by trade wars and disputes over technology between the US and China.

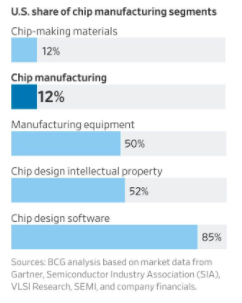

At the same time, American chip companies realize that the United States has lost its monopoly on chip design and other fields, and the manufacturing industry as a basic industry is increasingly dependent on foreign countries.

The rise of semiconductor manufacturing companies such as TSMC and Samsung has made the United States more worried because most of these companies’ factories are not located in the United States. In addition, raw materials used in chip manufacturing, such as monocrystalline silicon, are also available in many regions outside the United States.

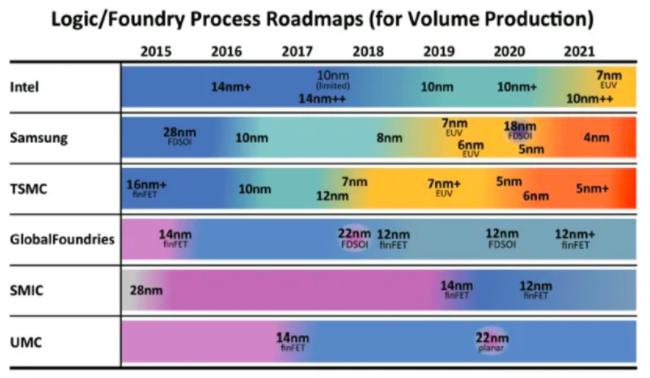

At present, there are only three semiconductor companies in the world that can have processes below 10nm: Intel, TSMC and Samsung. Among the three, TSMC’s technology is the most advanced.

Intel has been surpassed by Samsung and TSMC in process

The U.S. still has an advantage in the ubiquitous design software in the chip field. According to Gartner’s survey data, the U.S. has an 85% market share in chip design software, which is absolutely dominant.

According to the statistics of TrendForce, a semiconductor industry analysis company, among the top 10 IC design companies without self-built factories in the world in 2019, 6 are from the United States, namely Qualcomm, Broadcom, Nvidia, AMD, Xilinx and Maiwei. It is worth noting that the chips of these companies are all foundry by TSMC.

With Asia’s economic and technological development, high-tech manufacturing has been shifting to these regions. If the current development trend is followed, the US’s share of chip manufacturing is expected to further decline in the next few years.

Chips play a pivotal role in the security of a country. It has become a basic consensus, supporting all aspects of life, and is also a necessity in military technology and other fields related to national defense security.

Promoting the localization of high-end manufacturing, subsidies have become the biggest temptation to set up factories in the United States

The impact of the novel coronavirus pandemic on employment has given the United States additional motivation to promote high-end manufacturing back to the United States.

Some analysts pointed out that the incentives of the US authorities will help the manufacturing industry return, thereby increasing local employment.

In May of this year, TSMC announced its intention to build a 5nm factory in the United States. The site will be located in Arizona, and the goal is to start production in 2024.

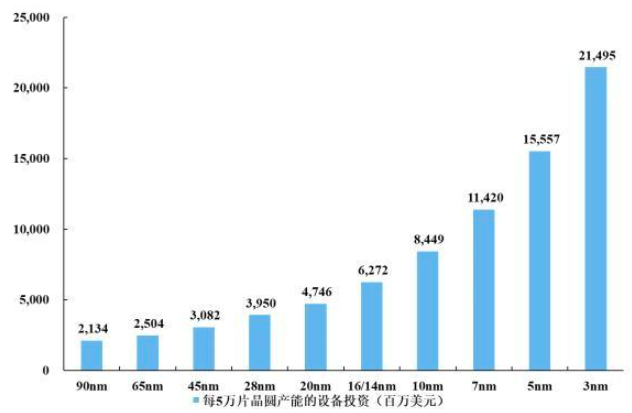

The chip factory’s lithography machine and other core manufacturing equipment are of great value. ASML’s lithography machine is hundreds of millions of dollars, and the construction of a complete 7nm chip factory may cost more than 30 billion dollars. These chip factories will fall behind in about ten years. Therefore, the large subsidy incentives of local governments may give priority to some chip factories.

Taiwan Semiconductor Manufacturing Co., Ltd. is building factories in the United States. On the one hand, there is pressure from the United States, and on the other hand, it is based on its own economic interests.

Most of TSMC’s current head customers are in the United States, and business contacts will be more convenient, and it will also be able to get land and tax incentives from local governments in the United States. In addition, high-end chip talents from the United States can also be attracted to TSMC.

However, the cost of building a factory in the United States will be 3-5 times higher than that in Taiwan. TSMC Chairman Liu Deyin said that “the cost is a big problem. The US government subsidy is the key. We are waiting for the US Congress to pass the relevant bill currently.”

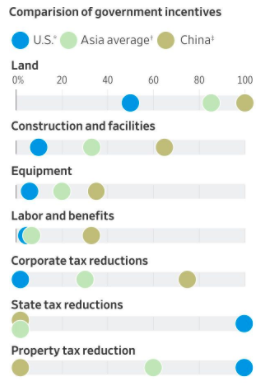

The United States has not traditionally provided federal incentives for chip manufacturing, but states do provide quite a bit of temptation to fight for these “cash cows,” as well as land sponsorship and tax relief.

The percentage of subsidies in the United States, Asia average and China

Whether the localization of high-end manufacturing in the United States can succeed, TSMC will become the most important “touchstone.”

Comments